Olivier Andries cautions against setting unrealistic industrial targets as global supply chains grapple with external shocks and pandemic aftermath.

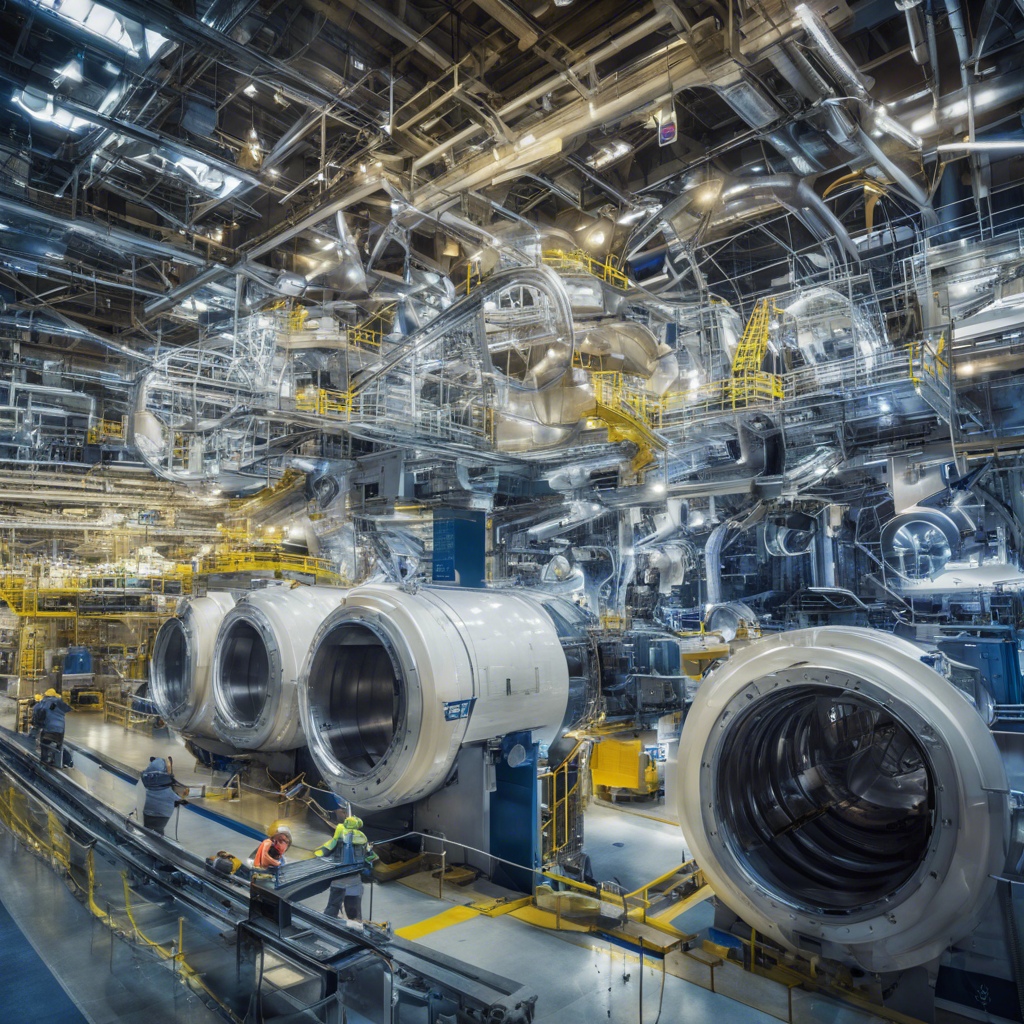

The head of French jet engine maker Safran, Olivier Andries, has expressed concerns over the recovery of global supply chains from a series of external shocks, including the pandemic, Ukraine crisis, energy fluctuations, inflation, and labor issues. Speaking during a visit to Morocco to strengthen supply chain partnerships, Andries emphasized the need for a cautious approach to ramping up production in the aviation industry, despite the growing demand for air travel. This warning comes as Safran, in collaboration with GE, produces LEAP jet engines for major aircraft manufacturers such as Boeing and Airbus.

Supply Chain Challenges:

Andries highlighted the ongoing struggles faced by supply chains, which have yet to return to normal levels following the disruptions caused by the pandemic. While demand remains strong, the supply chain’s ability to meet it is hindered by various factors. Citing supply issues, CFM, the joint venture between Safran and GE, has revised its growth forecast for LEAP engine deliveries in 2023 to 40-45%, down from the initial estimate of around 50%. This adjustment implies the delivery of approximately 1,600 to 1,650 units.

Ambitious Targets with Realistic Expectations:

Andries reaffirmed the preliminary target of delivering 2,000 LEAP engines in 2024, subject to final discussions with GE. However, he cautioned that this goal already represents a significant challenge given the current state of the supply chain. The CEO emphasized the importance of remaining realistic and not making commitments that cannot be achieved. While CFM plans to increase LEAP deliveries in 2025, precise volume agreements with aircraft manufacturers are not expected until mid-2022.

Balancing Output and Demand:

Engine manufacturers, including CFM, have been more cautious than aircraft manufacturers, such as Airbus, in increasing production to meet the rising demand for air travel. Andries noted that engine supplies are among the biggest risks for planemakers. While CFM is prepared to accommodate pre-pandemic output levels, Andries acknowledged that planemakers have been adjusting their demand projections as the years progress. He cited Airbus’s decision to postpone its target of producing 75 twin-engined narrow-body jets per month from 2025 to 2026. However, Airbus remains confident in achieving this goal after missing targets in 2022.

CFM’s Market Share and Future Outlook:

Andries revealed that CFM continues to base its assumptions on a market share of 60% at Airbus, where it competes with Pratt & Whitney, and 100% at Boeing, where it is the sole supplier for the 737 aircraft. While he did not provide a numerical estimate for 2025, Andries’ production and market share estimates suggest deliveries of approximately 2,200-2,300 engines, accounting for spares output and deliveries for the new Chinese Comac C919 jet.

Conclusion:

As the aviation industry grapples with the challenges of recovering supply chains and meeting the surging demand for air travel, Safran CEO Olivier Andries emphasizes the need for a cautious and realistic approach to ramping up production. While demand remains strong, external shocks and ongoing supply chain struggles necessitate careful planning and coordination between engine manufacturers and aircraft producers. Balancing ambitious targets with the current state of the supply chain is crucial to ensure a sustainable and efficient recovery in the aviation industry.