Strong November for Startup Funding with Impressive Raises

November proved to be a robust month for startup funding in the U.S., defying expectations of a slow period due to the holiday season. Several companies secured massive funding rounds, with some surpassing the $100 million mark. From e-cigarette maker Juul to space tech company Firefly Aerospace, these funding rounds highlight the diverse range of industries attracting significant investment. Let’s take a closer look at the top 10 funding rounds in the U.S. for November.

Juul: Leading the Way with a $1.3B Raise in Consumer Goods

Juul, the San Francisco-based e-cigarette maker, secured the top spot with a staggering $1.3 billion in funding. The company, which faced legal challenges earlier this year, laid off employees and cut costs. The recent funding will help Juul continue its operations and expand its market presence. The investors for this round were not disclosed.

Firefly Aerospace: Reaching for the Stars with a $300M Raise in Aerospace

Firefly Aerospace, a space transportation startup based in Cedar Park, Texas, raised $300 million in a Series C funding round. The exact amount raised in November is unclear, but the total funding for the Series C round reached $300 million. The new cash values the company at $1.5 billion pre-money. Investors include AE Industrial Partners and Mitsui & Co., Ltd., among others.

Next Insurance: Insurtech Startup Raises $265M with Strategic Partnerships

Next Insurance, a Palo Alto-based insurtech startup specializing in small business insurance products, raised $265 million in a strategic funding round. The round was led by insurance giants Allstate and Allianz’s investment arm, Allianz X. This funding will deepen Next Insurance’s existing reinsurance relationship with Allianz and establish a new strategic partnership with Allstate. The valuation of the company was not disclosed.

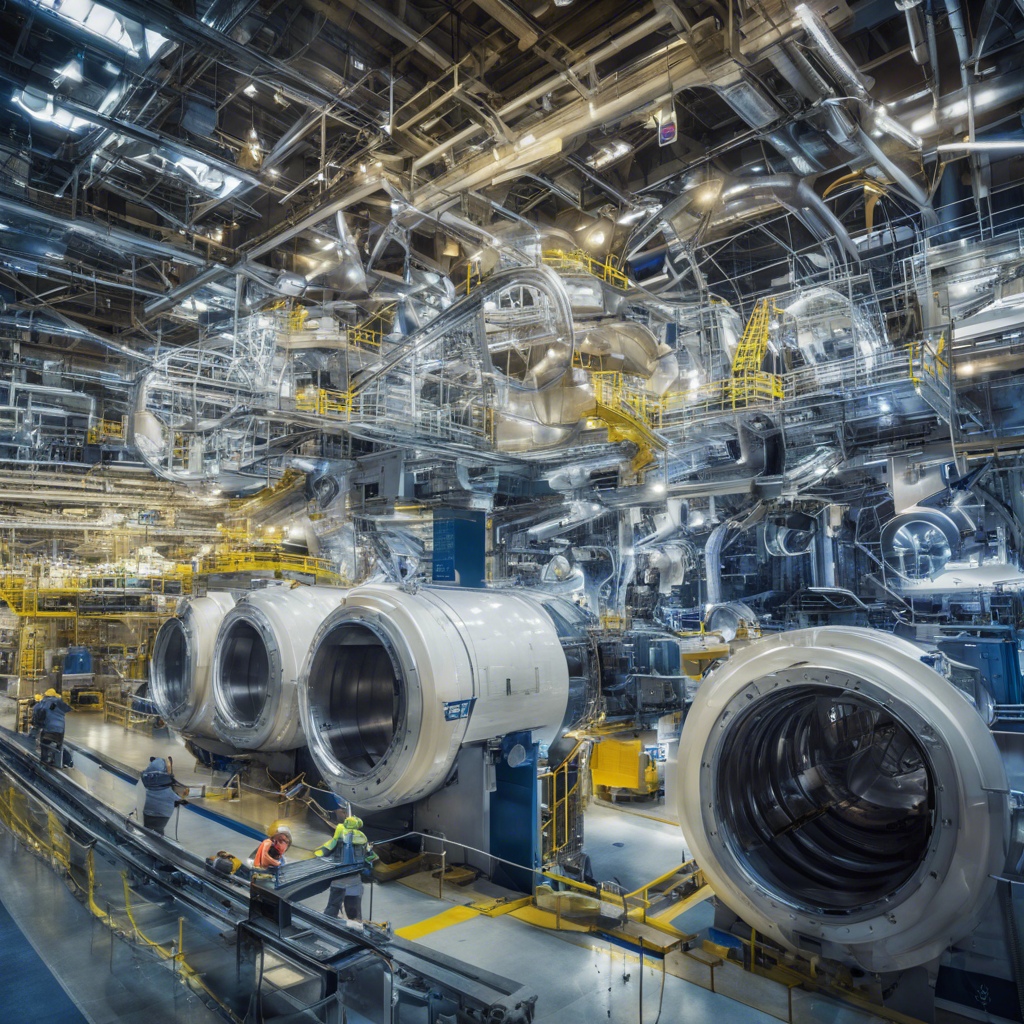

Divergent Technologies: Accelerating Digital Manufacturing with a $230M Raise

Divergent Technologies, a Los Angeles-based manufacturing company, raised $230 million in a Series D funding round. The funds will be used to accelerate the commercialization of its digital manufacturing system, which utilizes generative AI and 3D printing. Hexagon AB led the round with a $100 million investment. Divergent Technologies’ system has applications in various industries, including automotive and aerospace.

DataBank: Information Technology Firm Raises $188M for Data Center Construction

DataBank, a consulting and tech services firm based in Dallas, raised $188 million in a combination of debt and equity to fund the construction of new data centers. The funding consists of $188 million from existing and new investors, as well as a $345 million loan for a new data center in Atlanta. The company previously raised $350 million in credit facilities and $715 million in secured notes.

Infinitum Electric: Industrial Automation Startup Raises $185M

Austin-based startup Infinitum Electric raised $185 million in a Series E funding round led by Just Climate. The company develops light air-core motors and aims to meet the growing demand for decarbonization in the industrial sector. The implementation of new motor technology could result in significant cost savings and energy efficiency improvements.

Terremoto Biosciences: Biotech Firm Raises $175M for Targeted Medicines

Terremoto Biosciences, a biotech firm based in South San Francisco, closed a $175 million Series B funding round. The round included participation from Novo Holdings and OrbiMed. Terremoto Biosciences focuses on developing targeted, small molecule medicines for severe diseases. The company has raised a total of $250 million to date.

BlueVoyant: Cybersecurity Startup Raises $140M for Defense Tech Expansion

Managed detection and response startup BlueVoyant raised over $140 million in a Series E funding round led by Liberty Strategic Capital. The funding facilitated the acquisition of Conquest Cyber, a cybersecurity company specializing in protecting critical infrastructure sectors. BlueVoyant has raised nearly $666 million since its inception in 2017.

Enable: Finance Startup Raises $120M for Rebate Management Platform

San Francisco-based startup Enable raised $120 million in a Series D funding round led by Lightspeed Venture Partners. Enable offers a rebate management platform that helps manufacturers, distributors, and retailers optimize sales and growth. The funding will support the company’s expansion and enhance its real-time data and forecasting capabilities.

May Mobility: Autonomous Vehicle Startup Raises $105M

May Mobility, an Ann Arbor-based autonomous vehicle startup, closed a $105 million Series D funding round led by NTT Group. The company develops AV technology and deploys fleets of vehicles to municipal and business customers. Despite a challenging year for autonomous vehicle startups, May Mobility has secured approximately $300 million in funding since its founding in 2017.

RefleXion Medical: Biotech Company Raises $105M for Cancer Therapies

Hayward-based biotech firm RefleXion Medical raised $105 million in equity funding. The round was led by The Rise Fund, TPG’s impact investing strategy. The funds will be used to expand the commercialization of the company’s therapy for treating solid tumor cancers. RefleXion Medical has raised a total of $675 million.

Conclusion:

November showcased the resilience and innovation of startups across various industries. From e-cigarettes to aerospace, insurtech to manufacturing, these top 10 funding rounds highlight the diversity of the startup ecosystem in the U.S. These companies are poised to make significant contributions in their respective fields, driving economic growth and technological advancements. As we enter the final month of the year, it will be interesting to see if the momentum continues into December and beyond.