The recent signing of the Defense Bill and improving air travel projections offer hope for the aerospace-defense industry, but supply-chain issues and a strengthening dollar pose challenges.

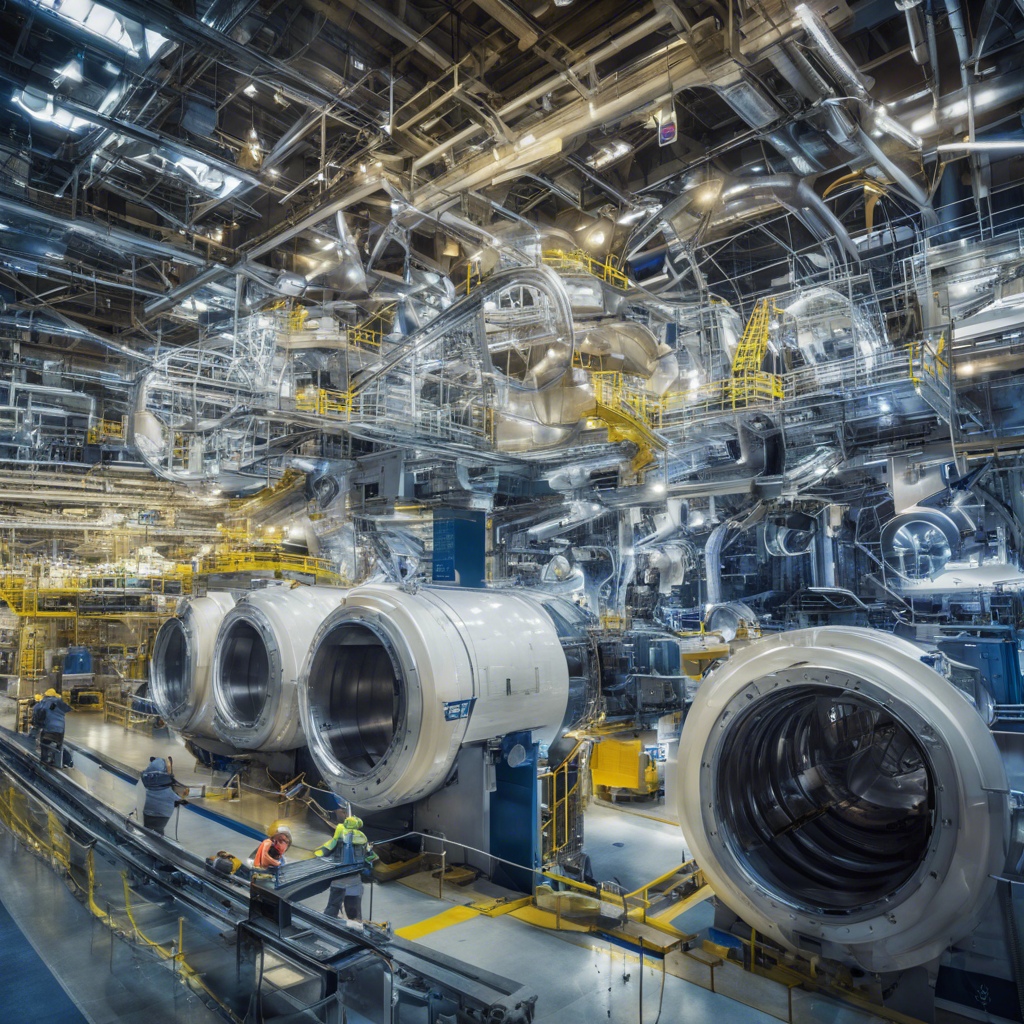

The aerospace-defense industry, comprising companies involved in the design, manufacture, and maintenance of military and commercial aircraft, faces a mix of opportunities and challenges. The signing of the Defense Bill worth $886 billion by the U.S. President provides a boost to defense-focused companies, while improved projections for air travel offer hope for commercial aerospace manufacturers. However, supply-chain disruptions and a strengthening U.S. dollar present hurdles for the industry. In this article, we will delve into the key trends shaping the future of the aerospace-defense industry and highlight three companies that are well-positioned to navigate these challenges and seize growth opportunities.

Expanding Defense Budget Remains a Growth Catalyst:

Despite the impact of the COVID-19 crisis on various industries, the defense side of the aerospace-defense industry has remained resilient, bolstered by steady government support. The recent signing of the Defense Bill, authorizing a record $886 billion in annual military spending, sets the stage for increased contract wins for defense-focused companies. This boost in budgetary provisions is likely to drive growth in the defense segment of the industry, supporting the top line of industry players.

Improved Air Traffic Outlook Boosts Prospects:

The recovery of global air traffic data in recent times has provided a glimmer of hope for the commercial aerospace segment. The International Air Transport Association (IATA) reports a significant increase in industry-wide global revenue passenger kilometers (RPK), reaching 92.9% of pre-pandemic traffic numbers. Projections for air passenger revenue growth in 2023 are also optimistic, with a year-over-year increase of 38%. These positive trends bode well for commercial aerospace manufacturers, who have faced challenges such as delayed jet deliveries and order cancellations by airlines.

Supply-Chain Issues May Hurt:

The aerospace-defense industry has grappled with significant supply-chain disruptions due to lower aircraft demand and restrictions on the movement of people and goods. Small suppliers, particularly those heavily exposed to commercial aerospace and the aftermarket business, have been significantly impacted. While the global economy is showing signs of improvement, supply-chain issues are expected to persist, resulting in lower aircraft deliveries in 2023 compared to pre-pandemic levels. This could restrain the growth trajectory of the industry in the near term.

Strengthening Dollar Adds to Industry Woes:

The appreciation of the U.S. dollar poses an additional challenge for the aerospace-defense industry. Airlines already burdened with high inflation and rising jet fuel prices now face increased costs due to the strengthening dollar. This burden on airlines could lead to lower aircraft deliveries, negatively impacting industry players operating in the commercial aerospace segment.

Conclusion:

The aerospace-defense industry is navigating a complex landscape of opportunities and challenges. The signing of the Defense Bill and improving air travel projections offer hope for growth, particularly for defense-focused and commercial aerospace companies. However, supply-chain disruptions and a strengthening U.S. dollar present hurdles that need to be addressed. Companies such as Safran, Textron, and Leidos Holdings are well-positioned to navigate these challenges and capitalize on the opportunities presented by the evolving aerospace-defense industry. As the industry continues to adapt and innovate, stakeholders must remain vigilant and agile to thrive in this dynamic landscape.