CEO Tufan Erginbilgic unveils a strategic plan to increase annual operating profit to £2.8 billion by 2027, driven by improved profit margins in the civil aerospace business.

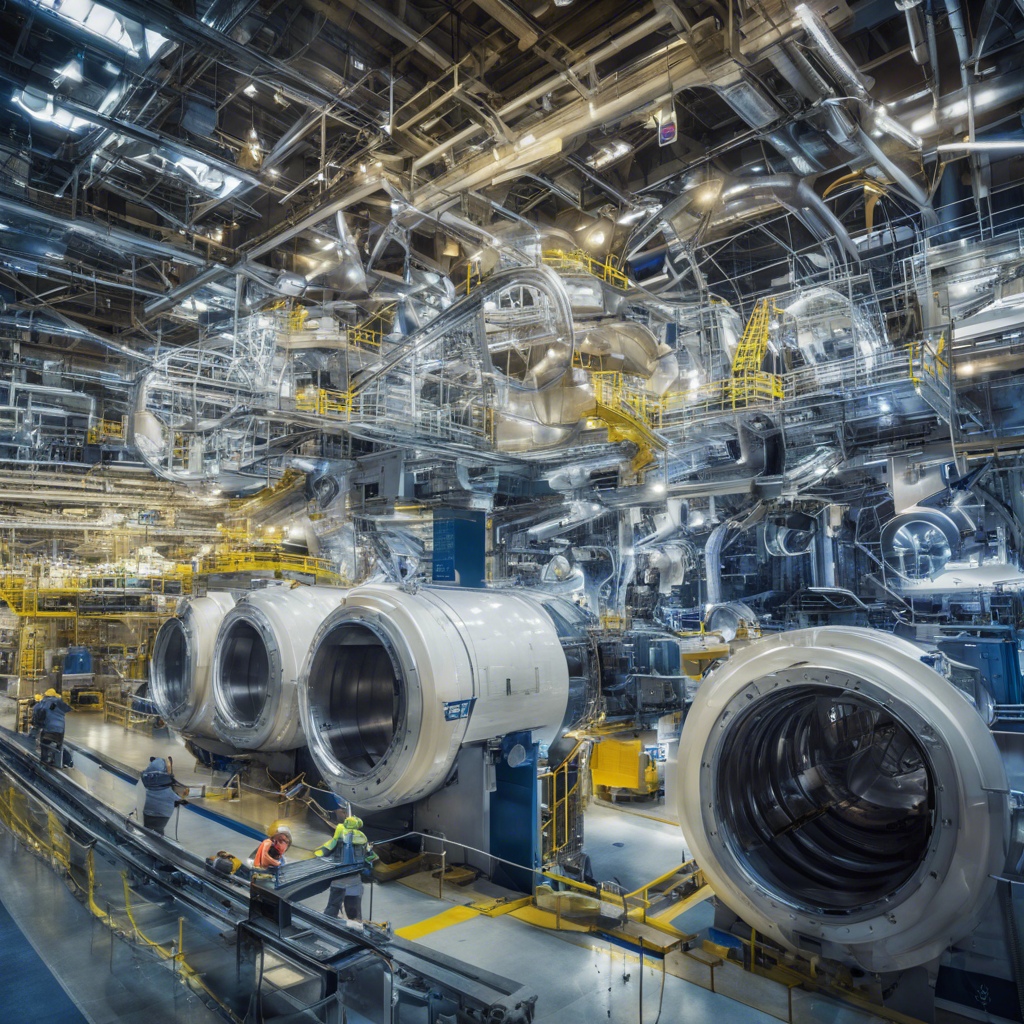

Rolls-Royce, the renowned British engineering company, has unveiled an ambitious five-year plan to quadruple its profit by 2027. CEO Tufan Erginbilgic aims to boost the performance of the company’s jet engines and reduce costs to achieve this goal. The strategy, which focuses on improving profit margins in the civil aerospace sector, aims to position Rolls-Royce as a major player in the widebody plane sector, business aviation, defense, and power systems. As part of the plan, the company also intends to sell its electrical-powered aircraft business and explore partnerships to re-enter the single-aisle jet market.

Rolls-Royce Targets Surge in Profit Margins in the Civil Aerospace Business

Rolls-Royce plans to significantly increase profit margins in its civil aerospace business, aiming for a range of 15-17% compared to last year’s 2.5%. This surge in profit margins will be driven by various factors, including extending the “time on wing” of its engines between maintenance, reducing manufacturing and repair costs, implementing a new pricing strategy, and addressing low-margin contracts. By achieving these targets, Rolls-Royce aims to bring itself closer to competitors such as General Electric, its major rival in the widebody plane sector.

Non-Core Asset Sales and Potential Partnerships

To raise additional funds and streamline its operations, Rolls-Royce plans to sell non-core assets and explore potential partnerships. As part of this strategy, the company will divest its electrical-powered aircraft business, with the goal of raising up to £1.5 billion. Additionally, Rolls-Royce is considering re-entering the single-aisle jet market through partnerships, leveraging its next-generation UltraFan technology. This move would allow the company to tap into the market currently dominated by RTX’s Pratt & Whitney and CFM International, a joint venture between Safran and General Electric.

Market Share Optimization and Profitability

CEO Tufan Erginbilgic emphasized that while Rolls-Royce aims to capture market share, it will prioritize profitability. The company had a 55% share of widebody deliveries last year, and Erginbilgic expects that level to continue this year, with anticipated growth over the next five to ten years. This marks a shift in strategy from Rolls-Royce’s traditional focus on market share optimization. Analysts view this change as a deeper cultural shift within the company, indicating a willingness to sacrifice revenue in exchange for improved profitability.

Recovery and Positive Financial Outlook

Rolls-Royce’s financial performance was impacted by challenges with its Trent 1000 engine and the COVID-19 pandemic, which led to grounded long-haul aircraft and a decline in revenue tied to engine flying hours. However, under CEO Tufan Erginbilgic’s leadership, the company has experienced a rapid recovery. In August, first-half operating profit increased five-fold, aided by higher engine maintenance prices and strict cost management. The positive financial outlook, coupled with the strategic plan unveiled by Erginbilgic, has boosted investor confidence, with Rolls-Royce shares surging 161% year-to-date.

Conclusion:

Rolls-Royce’s ambitious five-year plan, spearheaded by CEO Tufan Erginbilgic, aims to quadruple the company’s profit by 2027. By focusing on improving profit margins in the civil aerospace business, reducing costs, and exploring new partnerships, Rolls-Royce aims to position itself as a leader in the widebody plane sector, business aviation, defense, and power systems. The company’s shift towards prioritizing profitability over market share optimization reflects a deeper cultural change within the organization. With a strong recovery underway and a positive financial outlook, Rolls-Royce is poised for significant growth in the coming years.